Loan officers play a crucial role in the financial industry by helping individuals and businesses secure loans for various purposes. From mortgages to business loans, loan officers are responsible for evaluating loan applications, determining creditworthiness, and ultimately approving or denying loan requests. In order to make informed decisions, loan officers rely on a variety of tools and resources to assess the financial health of potential borrowers.

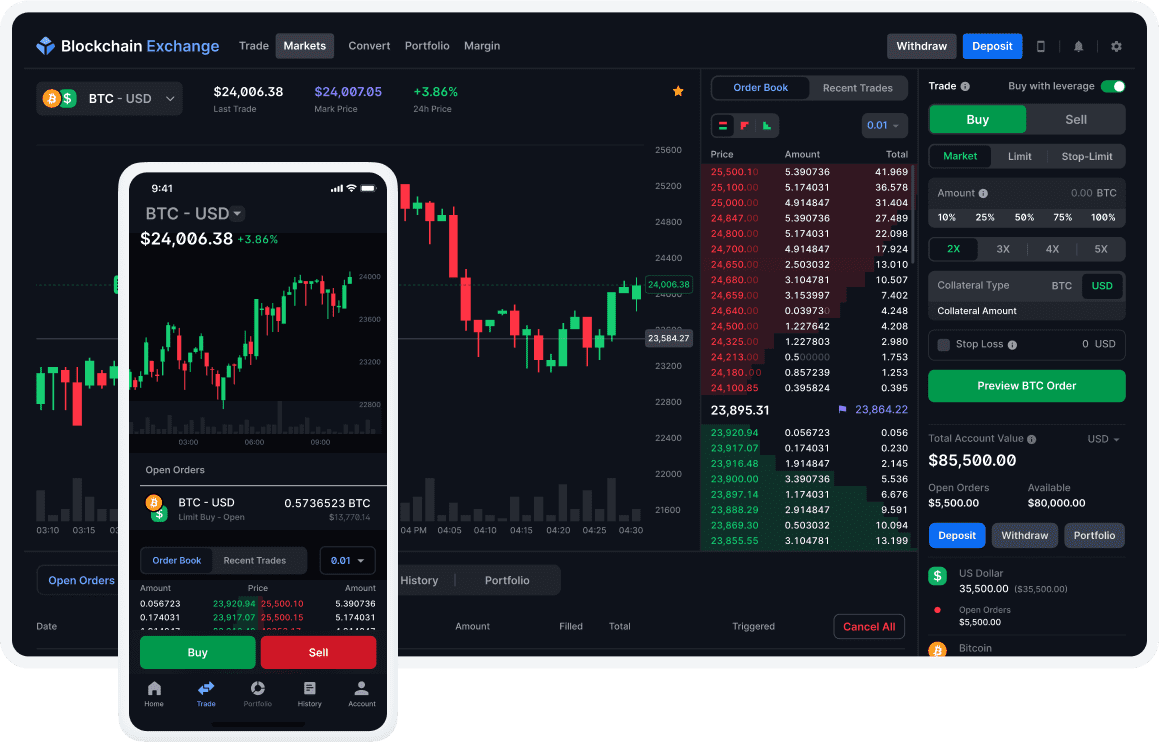

One such tool that has revolutionized the way loan officers evaluate applicants is Stock DB. Stock DB is an innovative platform that provides loan officers with real-time access to a wealth of financial data, including stock market information, company profiles, and industry trends. By leveraging this powerful tool, loan officers can quickly assess the financial stability of potential borrowers and make more accurate lending decisions.

Stock DB allows loan officers to easily access key financial metrics such as revenue growth, profitability ratios, and debt levels for individual companies. This information is critical in determining the creditworthiness of borrowers and assessing their ability to repay loans. With Stock DB’s comprehensive database of financial data, loan officers can quickly identify red flags such as declining revenues or excessive debt levels that may indicate a higher risk borrower.

In addition to 주식db providing detailed company-specific data, Stock DB also offers valuable insights into broader market trends and industry dynamics. Loan officers can use this information to better understand the overall economic environment in which potential borrowers operate and anticipate any potential risks or opportunities that may impact their ability to repay loans.

One of the key features that sets Stock DB apart from other financial analysis tools is its user-friendly interface. The platform is designed with ease of use in mind, allowing even novice users to navigate complex financial data with ease. Loan officers can quickly search for specific companies or industries, compare key metrics across multiple companies, and generate customized reports tailored to their specific needs.

Another major advantage of Stock DB is its real-time updates feature. As stock prices fluctuate throughout the day based on market conditions and news events, it’s essential for loan officers to have access to up-to-date information when evaluating potential borrowers. With Stock DB’s real-time updates feature, loan officers can rest assured that they are making decisions based on the most current data available.

Overall, Stock DB has proven to be a game-changer for loan officers looking to streamline their workflow and make more informed lending decisions. By providing easy access to comprehensive financial data and valuable market insights in real time, Stock DB empowers loan officers with the tools they need to succeed in today’s fast-paced lending environment.